- Outstanding mainstream appeal which is cleverly being targeted.

- Tackling one of the world's most critical issues using blockchain technology.

- Using an STO allows investors to own a piece of the project and expect a profit on their investment.

- Timeline is very bare.

- Concerns over key members positions at other organisations.

- Unproven team in the datacentre, energy and crypto sectors.

The GEAR concept is simple - We clean out Blockchain Proof-of-Work systems by using energy from the full spectrum of Green, Clean and Renewable sources, including but not limited to, solar, wind, tidal, hydroelectric and biomass. Our Green Energy Mining Farms provide further security to cryptocurrency networks by deploying clean energy 'hashing power' used in the mining process - the output of which is cryptocurrency such as Bitcoin, Ethereum, Litecoin, Dash and Ripple.

Green Energy and Renewables (GEAR) STO Fast Facts

- STO Crowdsale Start Date: Private Sale 15 August 2018. Presale 1 November 2018. Crowdsale 1 December 2018.

- Maximum Discount: Private sale participants will receive a 50% discount compared to Crowdsale.

- Platform: Ethereum ERC-20 Standard

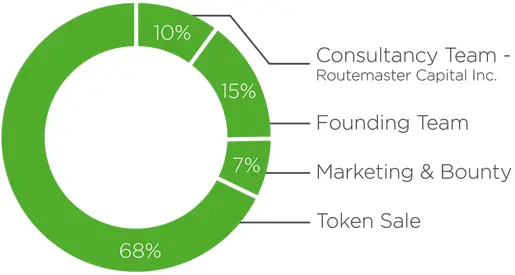

- Amount Raised (and valuation): USD 15m soft cap and USD 100m hard cap. 68% of tokens sold, indicating a fully diluted market cap of $22m to USD 147m.

- Lightpaper: http://snip.ly/lightpaper/

Green Energy and Renewables (GEAR) Utility

GEAR is in the first cohort of digital assets raising money via a Security Token Offering (STO). Check out our guide on Security Tokens to understand why a project would choose to use a security token as well as the benefits they bring over a standard Utility Token.

Security Tokens provide significant advantages to the GEAR project. Investors now have more assurances that they will receive a financial benefit if the company does well. Forward-looking statements and offers of dividends and passive income are also able to be discussed (and promoted!) by the team. This token is an investment vehicle which potentially allows a return of profit to investors, where a utility token would have just enabled the project to function.

GEAR will create an ecosystem which allows investors not just to purchase and hold cryptocurrencies, but to also invest in an entire mining and digital asset investment operation. This will enable investors to reap the dividends as passive income as the enterprise grows.

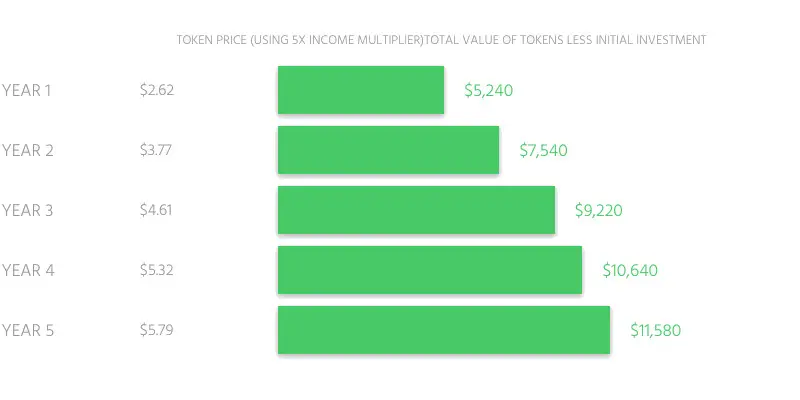

With a fixed rate of return to investors, there are concerns that this will create an artificial price cap, once the price of the token reaches a certain value. Also of concern is the failure to mention the affects that changes in hashing difficulty will have to the future value. Considering the number of future value graphs provided (which is a little strange to begin with), this seems like a major oversight.

Green Energy and Renewables (GEAR) Team, Advisors, Partners and Investors

I have to start with the elephant in the room, and that is their advisory board. It is clear that GEAR is doing things differently. They have handpicked people that aren’t the same rehashed advisors from the blockchain industry. Instead they’ve gone with real titans, media moguls and ‘old money’ fund managers from the mainstream.

- Larry King: Creator and Star of CNN show ‘Larry King Live’.

- Jim Rodgers: Chairman of Rogers Holdings and Beeland Interests Inc.

- Stan Bharti: Founder and Chairman of Global Merchant Bank, Forbes and Manhattan Inc.

I have to admit, I am a little torn about this. It is great to see a crypto project NOT go with the usual ‘blockchain advisors’, as it breaks the crypto echo chamber and grabs the attention of an entirely new audience. On the other hand, seeing ‘celebraties’ on these types of projects does raise some alarm bells for me. I’ll take it at face value for now, as the entertainment empire of Larry King alone is impressive. He can reach a large amount of non-crypto investors. This is great, not only for the project, but also for the entire blockchain industry as a whole.

Jim Rogers and Stan Bharti both head up impressive and significant organisations in the financial industry. The presence of these ‘old money’ institutions not only shows growing acceptance in blockchain projects. The knowledge, experience and connections(!) they can bring to the GEAR project is significant.

The core GEAR team is led by Indi Pathak and Vik Pathak. Both have strong business and financial backgrounds. Indi worked at Deutsche Bank, Cadbury and Rogers AT&T after graduating with a Bachelor of Commerce in 1992. Vik graduated with a Bachelor of Business Management, after which he found work at American Express and Fura Gems before heading digital investment firm Routemaster Capital in 2018.

The legal entity of Gear Blockchain Inc is incorporated in Babados at an address previously associated with the Panama Papers release and currently registered to an offshore management company [Link has now been removed]

It would have been nice to see team members with close connections to Bitmain, experience in construction or knowledge in how to manage a data centre.

| Date | Announcement |

|---|---|

| 8 Aug 1996 | Rodinia Lithium Inc opened on the Toronto Stock Exchange at CAD $0.27. |

| 16 Sep 2016 | Following a Special Meeting of shareholders, the business announces they have completed a change of Business and was reborn as Routemaster Capital Inc, opening at CAD 0.10 after a 10:1 stock consolidation. |

| 11 Dec 2017 | Routemaster Capital announces Vikram Pathak as a new appointee to the board of directors |

| 14 Dec 2017 | Routemaster Capital announces it will invest $1.35m to acquire a 49% interest in Pinedale Springs LLC ("Pinedale") in Cary, North Carolina. "Pinedale currently owns and operates a solar farm and cryptocurrency data centre in Cary, North Carolina". "With the completion of this Transaction, the Company will have an investment in a company that has a "proof of concept" facility to undertake cryptocurrency mining with significantly lower carbon dioxide emissions than traditional fossil fuel power generation. Pinedale's solar-cryptocurrency facilities are currently cash flow positive." |

| 18 Dec 2017 | Routemaster announces $500k worth of stock options 'to various directors, officers and consultants', exercisable in 5 years time. |

| 8 Feb 2018 | Routemaster announces a non‑brokered private placement financing of $5 million. Routemaster may pay finder’s fees to eligible finders in accordance with the policies of the TSX Venture Exchange. "Routemaster intends to use the proceeds from the Financing for general corporate purposes, investment opportunities in blockchain technologies ... and the clean energy and renewable energy sector". |

| 1 Mar 2018 | Routemaster announces cooperation agreement with GEAR Blockchain. "GEAR is currently working to launching its own token network via an initial coin offering (“ICO”) in Barbados. Pursuant to the agreement among Routemaster and GEAR dated February 26, 2018, Routemaster will provide GEAR with management consulting services and up to US$2 million in cash to be used by GEAR for the launch of its ICO. Routemaster will not be issuing any shares to GEAR pursuant to the Transaction. As consideration for Routemaster’s financial and management support, Routemaster will be issued 10% of the GEAR tokens issued pursuant to the proposed ICO. The term of the agreement is for one year". "Routemaster and GEAR are arm’s length parties. The GEAR team is comprised of highly talented and experienced experts across a multitude of backgrounds, including finance, marketing, blockchain and technology. Mr Orlando Bustos, a consultant for the Forbes & Manhattan Group, is an insider of GEAR. GEAR is incorporated in Barbados and will comply with all applicable securities laws." |

| 14 Mar 2018 | Forbes publishes an article with Vikram Pathak (as Fura Gems head of investor relations) discussing using the blockchain to track precious stones from mine to retail store. |

| 14 Mar 2018 | Routemaster announces the appointment of Vikram Pathak as President and CEO, effective immediately. Mr Pathak will continue to serve as a Director of Routemaster. |

| 19 Mar 2018 | Routemaster announces the appointment of Justin Wu as the blockchain growth advisor for GEAR. "To kickoff GEAR’s launch and to welcome Mr Wu to the team, GEAR held a 50 person blockchain and cryptocurrency mastermind on Wednesday, March 7, 2018, in Los Angeles. This is the first of many GEAR events to invite pioneers and curated influencers" in the blockchain and cryptocurrency industries to connect and collaborate with the team." |

| 3 Apr 2018 | Routemaster announces that GEAR is exploring the route of launching an initial token offering (“ITO”). "GEAR has now submitted a whitepaper for final review to a New York-based law firm. The law firm is an experienced legal advisor in the practice of investments, blockchain and token generation events such as Initial Coin Offerings and has vast experience in working on token sales under Regulation D, Regulation S and Regulation A, ensuring GEAR remains fully compliant with regulatory frameworks." |

| 12 Apr 2018 | Routemaster and GEAR Blockchain announce the appointment of David Hartmann, and The SilverLogic, as the Technology and Development Lead for GEAR. "It is with great pride that GEAR welcomes Mr Hartmann and his team. We are excited to use David’s expertise in computer science and blockchain to further explore the potential for green energy tokenisation and to develop the technical infrastructure to help drive further shareholder value." |

| 20 Aug 2018 | Routemaster announce that it intends to complete a non-brokered private placement financing of up to $1 million. |

| 30_Sep_2018 | The stock price of Routemaster has returned to a daily close of $0.08. |

Green Energy and Renewables (GEAR) Roadmap and Distribution

The GEAR roadmap is perhaps too focused on the past. The only forward-looking item listed is “GEAR Network launch at 100’ish MW of capacity” at some point in 2019. (Note: The MW figure differs slightly between the website and the whitepaper). For a project looking to raise USD 100m, this is very light on details. Given the size, it would have been nice to see a capital works schedule. This would include timelines for the construction of the facilities as well as the scheduled delivery of the mining equipment. It is one thing to plan for the operation of 100’s of Antminer units, but given how long the waitlist is for these, it is an entirely different matter to have these ordered and scheduled for delivery shortly from the manufacturer.

In the white paper, they do base their forward-looking assumptions on hydropower at a $0.05USD cost for KWh. I would have liked to have seen more details regarding this. Who the provider is, what stage of contract negotiations are they at, or even where the facilities are located.

Green Energy and Renewables (GEAR) Value and Transparency (Tokenomics)

Offering a security is the right approach here. While the market is getting excited about the possibility of a Bitcoin ETF, GEAR is proposing a desirable alternative to big money. Rather than just invest in Bitcoin and waiting for the price to appreciate, GEAR will allow its holders to invest in the mining of Bitcoin. This will enable them to benefit from prices rises in Bitcoin, as well as the increased supply from mining new coins (as well in profits from the investment arm, etc.).

Green Energy and Renewables (GEAR) Social Awareness

The team are currently doing the hard yards and attending a range of blockchain conferences across Asia and America at the moment. This aligns with their ‘old money’ and broader audience approach. Crypto fans typically hang out in a project’s Telegram channel, however, to reach a broader audience, you need to put your face out there, shake a few hands and kiss a few babies.

Online socials are low, but reasonable, considering the project is still in a stealth-like mode during the private sale. GEAR has a few hundred Telegram, Twitter, Facebook and Youtube followers. Interestingly there are a few thousand Instagram followers, a platform not typically favoured by the crypto crowd, but adored by regular users. GEAR is one of the projects I expect to see more on mainstream media rather than in the standard crypto outlets.

Green Energy and Renewables (GEAR) Summary

GEAR is using a Security Token Offering to allow investors to own a small part of a crypto mining and investment operation focused on sustainable energy. 90%+ of annual net income is reinvested in mining expansion, paid out to token holders or diversified into other investment opportunities in the Green Energy space. The team are focused on bringing awareness to the general public. This is shown consistently throughout their project, from their choice of advisors to their promotional campaigns.

Crypto Coin Disclosure

The author has no affiliation with the above token or with the promotion/marketing thereof.

He does not hold any tokens and has not participated in the private or public sale of GEAR.

Read about our transparency requirements.

Editor-in Chief

Related Posts

Subscribe to our newsletter!

Information