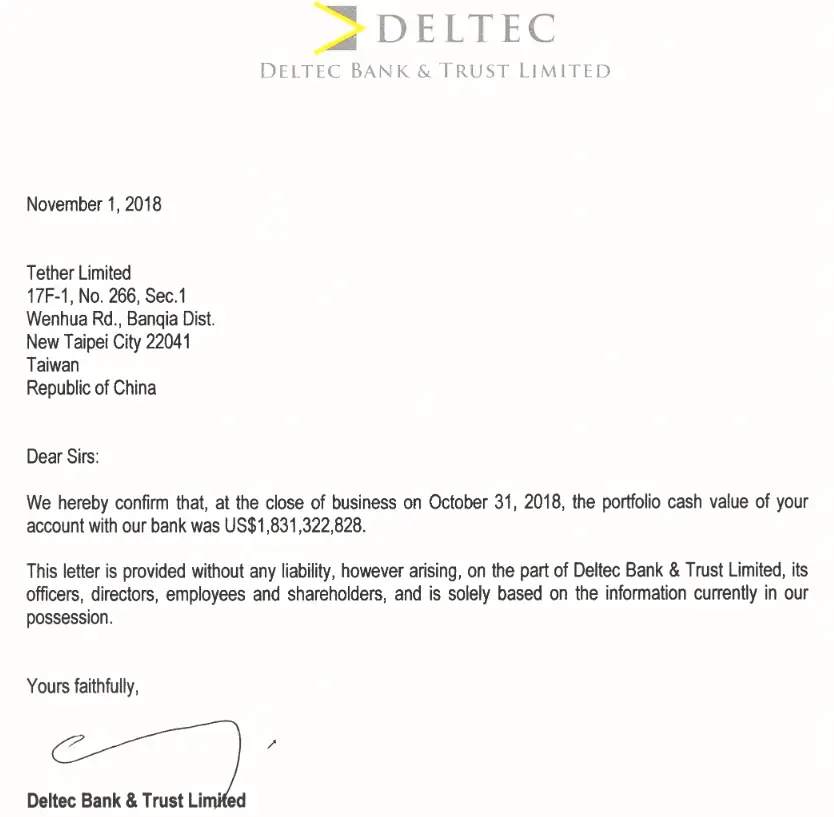

The release of a letter by Deltc (the Bahama-based bank of Bitfenixs’ tether) to alleviate investors concerns has failed to do so. In fact, it has raised more questions than answers.

Tether (USDT), one of the original stable-coins, is designed to remain fixed to USD. Stable-coins are a class of cryptocurrencies used by investors looking for stability without having to convert their digital assets back to fiat. Tether is owned and managed by BitFenix, one of the largest digital asset exchanges in the world. First launched in July 2014 as ‘RealCoin’, the coin was renamed to Tether in November 2014 and first traded in February 2015.

One of the key benefits of Tether is that it is back by a fiat currency (currently EUR and USD). For every 1 USDT in circulation, Tether holds 1 USD worth of fiat currency. To ensure this, Tether has always promised to be transparent and regularly audited.

Yes. Tether’s platform is built to be fully transparent at all times and is regularly audited. Every Tether is backed 100% by its original currency and can be redeemed at any time with no exposure to exchange risk. —Tether FAQ 2015.

Is this the first of the ‘regular audits’ Tether promised?

No. This is a copy of a private letter between Deltec Bank and Tether Limited (Tether), which Tether has decided to make public. The contents, while assumed legitimate, could have been modified before publication. Also, this is not an audit. The is an attestment. It is a single statement of fact at a certain point in time. An audit would take those facts and investigate their authenticity. For example, If Tether received a one-day loan in order to make satisfy the $1.8B USD balance requirement on that date. That would be true in an attestment but found to be fraudulent in an audit.

Is this sufficient evidence of currency backed?

No. Again this was not an audit. Also, considering the importance of an audit, a sub-50-word attestment is unlikely to ease investors minds over company worth almost $2 Billion USD. The wording used is pretty cagey and worth looking at.

We hereby confirm that, at the close of business on October 31, 2018, the portfolio cash value of your account with our bank was $1,831,322,828.

“The portfolio” raises some questions. While a portfolio may include non-USD currencies (hopefully just EUR), it may also include things like fine-art, yachts, sports cars and concerningly, even Bitcoin. As most investors use tether to provide some stability against a drastic event occurring to Bitcoin, the fact that their tether could be backed by Bitcoin is extremely concerning.

This letter is provided without any liability, however arising, on the part of Deltec Bank and Trust Limited

“Provided without any liability” is fairly common legal speak, it does confirm the casual nature of this letter. Again emphasising it is not an audit. Interestingly, it was addressed to Tether Limited in Taiwan. Tether is incorporated and apparently run from Hong Kong. While it is pretty regular for crypto entities to be registered in Hong Kong and operated from another location, this does raise further questions. This letter does not convey the transparency and trust that people who have $1.8B USD-worth of crypto deserve.

Why is there no name and only a squiggle?

The internet (well, at least Reddit, Twitter and Telegram) have pointed out that there is only an indecipherable signature at the end of the letter. No name, position, date or other items usually associated with a formal signature. While they are correct, again, this isn’t a formal audit. This is an internal letter between a bank employee and their client. Tether may as well have just gone to an ATM and asked for a balance receipt. It is not a formal statement by the bank and I doubt many investors would consider it so. The signature is a red herring to everything else that people should be concerned about.

Is this a concern?

At the end of the day, there still hasn’t been a single significant audit released by Tether Limited to confirm their reserve status. This is despite the promise, from day one, to have regular and transparent audits conducted. It is now 4 years since the coin was launched.

Tether has proven that it is not stable (twice dipping under $0.95 in the last month), not transparent (has never been fully audited) and not able to communicate effectively with its investors. These are not indicators I’d expect from a top ten cryptocurrency. Given the additional asset-based and mathematically proven stable crypto coins that have appeared in the last year, it may be worth investigating other options that are better suited to your investing requirements.

Editor-in Chief

Related Posts

Subscribe to our newsletter!

Information